Credit is a form of trust that allows a person or business to borrow money or goods with the promise to repay them later. When you use credit, you are essentially borrowing money from someone else and agreeing to pay them back, with interest, over a period of time.

Credit can be used to purchase a wide variety of goods and services, including cars, homes, and education. It can also be used to cover unexpected expenses, such as medical bills or car repairs.

Types of Credit

There are many different types of credit, but some of the most common include:

- Installment loans: These loans are repaid in equal installments over a set period of time. For example, you might take out an installment loan to buy a car, and then repay the loan over 5 years in monthly installments.

- Credit cards: Credit cards allow you to borrow money up to a certain limit, and then repay the money over time. You typically have to pay interest on the amount you borrow, but you can also earn rewards, such as cash back or travel miles.

- Lines of credit: Lines of credit are similar to credit cards, but they offer a larger borrowing limit. You can use a line of credit to cover unexpected expenses, or to consolidate debt from other sources.

- Revolving credit: Revolving credit is a type of credit that allows you to borrow money and then repay it, and then borrow again. The most common type of revolving credit is a credit card.

How Credit Works

When you use credit, you are essentially borrowing money from a lender, such as a bank or credit card company. The lender agrees to lend you the money because they believe that you are likely to repay them. They base their decision on your credit history, which is a record of your past credit activity.

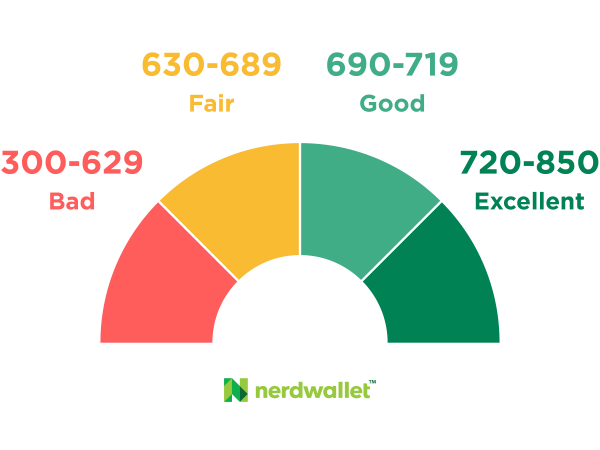

Your credit history includes information such as your payment history, the amount of debt you have, and the length of time you have been using credit. Lenders use your credit history to assess your creditworthiness, which is their estimate of your ability to repay a loan.

The Importance of Credit

Credit can be a valuable tool, but it is important to use it wisely. If you use credit responsibly, it can help you build a good credit history, which can make it easier to borrow money in the future. However, if you use credit irresponsibly, it can damage your credit history and make it more difficult to borrow money in the future.

How to Build Good Credit

There are a few things you can do to build good credit:

- Pay your bills on time. This is the most important factor in determining your credit score.

- Keep your credit utilization low. Your credit utilization is the percentage of your available credit that you are using. A good rule of thumb is to keep your credit utilization below 30%.

- Don’t apply for too much credit at once. Applying for a lot of credit in a short period of time can hurt your credit score.

- Dispute any errors on your credit report. If you see any errors on your credit report, such as a late payment that you didn’t make, dispute them immediately.

The Benefits of Good Credit

There are many benefits to having good credit, including:

- You can get approved for loans at lower interest rates.

- You can qualify for better credit cards with higher rewards.

- You may be able to get a lower security deposit on a rental property.

- You may be able to get a lower insurance premium.

The Dangers of Bad Credit

If you have bad credit, you may face the following challenges:

- You may be denied loans or credit cards.

- You may have to pay higher interest rates on loans.

- You may be required to make a larger security deposit on a rental property.

- You may be denied employment.

Conclusion

Credit can be a powerful tool, but it is important to use it wisely. If you use credit responsibly, it can help you build a good credit history, which can make it easier to borrow money in the future. However, if you use credit irresponsibly, it can damage your credit history and make it more difficult to borrow money in the future.

I hope this overview of credit has been helpful. If you have any further questions, please don’t hesitate to ask.